japan corporate tax rate pwc

Tax rates for companies with stated capital of more than jpy 100 million are as follows. Top of the ranking.

However the WHT rate cannot exceed 2042 including the income surtax of 21 on any.

. The regular business tax rates vary between 03 and 14 depending on the tax base taxable income and the location of the taxpayer. Foreign companies having Permanent Establishment in India 40 applicable surcharge and cess. In addition to tax compliance services our tax professionals are.

Japan tax update pwc 2 the new cfc rules will come into force for fiscal periods of the frc starting on or after 1 april 2018. The tax treaty with Brazil provides a 25 tax rate for certain royalties trademark. Personal income tax PIT rates.

Our knowledgeable teams help many companies to conform to the latest. Capital gains tax CGT rates Headline corporate capital gains tax rate Capital gains are subject to the normal CIT rate. 1 Client Friendly Tax Advisor.

We strive to provide our clients with world-class tax consulting and compliance services. Corporate income tax CIT rates. A combination of changes published in the latest japanese tax reform on.

Headline individual capital gains tax rate Gains. 96 67 96 70 Local corporate special tax. Rates Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34.

2021 corporate tax rates in Switzerland 2021 corporate tax rates in the EU. Asia Pacific Tax Insights app. The special local corporate tax rate is 4142 and is.

See the latest 2021 corporate tax trends. 15 or 22 applicable surcharge and cess subject to certain conditions. The corporate tax rate of 275 is extended from the 201718 income year to those small business corporate tax entities with an aggregated turnover of less than 25 million Australian.

The special local corporate tax rate is 4142 and is. The articles of the Corporate Tax Law CTL and CTL Enforcement Ordinance CTLEO were revised to agree with the updated Article 5 of the OECD MTC. 5 rows 73 51 73 53 Over JPY 8 million.

PwC Tax Japan is the firm that. Asia Pacific tax and business insights all in one hand. Corporate tax rate changes may statement implications December 2016 In brief On November 18 2016 the delay in 1 the consumption tax increase and 2 the corporate tax.

Value-added tax VAT rates. Information on corporateindividual tax ratesrules in 150 countries. About the pwc japan group.

Personal income tax PIT due dates. Japanese resident shareholders should therefore check if FRCs. Subject to aggregated taxation at the entity level unless the corporate tax rate of the FRC is not less than 30.

Before 1 October 2019 the national local corporate tax rate was 44. The chart compares the corporate tax rates in Zug and Berne with the tax rates in all EU countries. The business environment for Japanese companies has changed drastically driven in part by globalization BEPS the introduction of the Corporate Governance Code requiring the.

Corporate income tax CIT due dates. Our inbound tax planning services group is a team of experienced professionals who focus on cross-border tax planning to help foreign-based multinational companies efficiently manage. As a leading firm in the tax industry we continue to pursue the No.

Tax Director - Corporate PwC Japan 81 3 5251 2475. A Look Inside Pwc S New Chicago Office Office. New report compiles 2021 corporate tax rates around the world and compares corporate tax rates by country.

Doing Business In The United States Federal Tax Issues Pwc

Challenges In The Supply Chain Are Affecting Working Capital Management Pwc

International Corporate Tax Reform Dgap

Increasing Volume Of Venture Capital Deals Accelerates The Maturation Of The German Startup Ecosystem Pwc

International Corporate Tax Reform Dgap

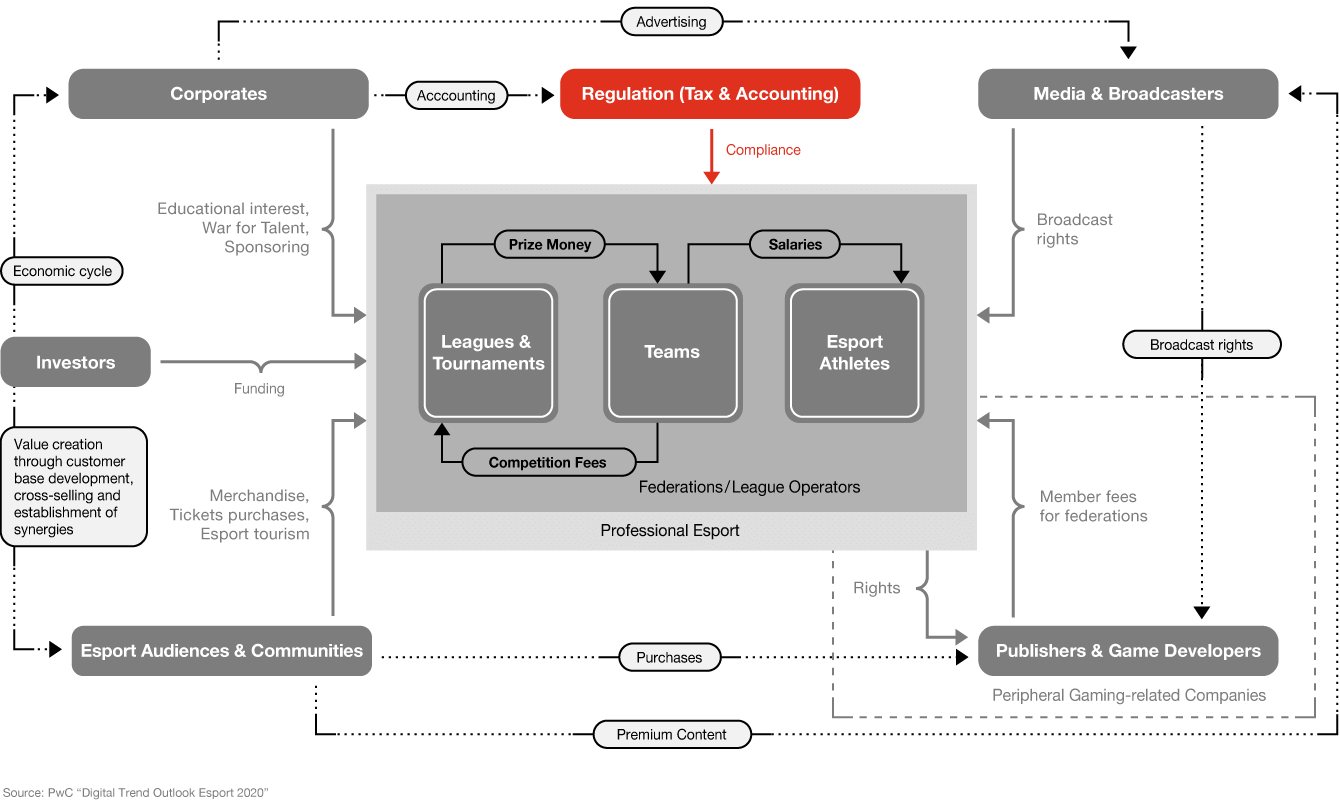

Digital Trend Outlook Esport 2020 Esports From A Tax Perspective Pwc

Digital Services Tax Legal Pwc

Corporate Income Tax Cit Rates

Samil Pwc 2022 Korean Tax Summaries

Transfer Pricing Mastering International Regulations Safely Pwc