stock option tax calculator canada

Locate current stock prices by entering the ticker symbol. Americas 1 tax preparation provider.

Step 2 Find the conversion ratio also called a gearing ratio in the.

. Y ou wont get taxed on the income again because you will have a cost basis in the stock that is approximately equal to what your proceeds were. If the US Company owns at least 10 of the voting stock of a company which is a resident of India and the US Company receives dividends then the income tax received by the Indian Government from the Indian company with respect to the profits from which dividends are paid shall be allowed as a credit. How you report your stock option transactions depends on the type of transaction.

Tax brackets though be sure to use a tax calculator to see how state taxes factor in. You will need TurboTax Premier to make the necessary entries in the Stocks Bonds Mutual Funds and Other interview in the Investment. Delta is on a scale from 100 to -100.

For Option 2 you calculate the tax on the projected income for the year and then find the tax amount that is proportional to the number of pay periods that have occurred including the current pay period. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Compare the result to.

Calculator to determine cost savings realized from a paycard program. Employer Paycard Savings Calculator. The tax ratearea defaults into the purchase order header from either the Ship To or the Supplier based on processing option 7.

Note calls and puts have opposite delta signs. You exercise your option to purchase the shares and you hold onto the shares. Be informed and get ahead with.

For example if the stock is selling for 25 per share when the warrants are issued the exercise price might be 40 or more. All provinces have some level of local tax and are based on a percentage of the federal tax system. Enter the Form 1099-B see steps below and it will automatically create Form 8949.

It may be helpful to compare these figures to the US. Taxes in Canada. Contact Us email protected 1 866-446-1009.

Stock Loan Solutions does not offer any form of investment buy or sell advice tax counseling estate planning or any other securities or financial. Paper gold also includes options that give buyers or sellers the ability to buy or sell futures contracts at a specified price within a specified period of time. Vertex software can coexist with the JD Edwards World tax calculator software which means that you can perform tax calculations using either or both of them.

Actually you do need to report the exercise of ISO stock if you did not sell all of the stock before year end and you do that by entering Form 3921 into TurboTax. 1 online tax filing solution for self-employed. Self-Employed defined as a return with a Schedule CC-EZ tax form.

Tax on Gold Investment in India Tax on Physical Gold Investment Any individual who sells physical gold will be subject to a 20 tax rate and 4 cess on LTCGLong-term capital gain. The Perfect Way for Small Cap Shareholders to Increase Their Liquidity. How much tax you pay will depend on how long you hold your Bitcoin.

Deep-in-the-money options eventually move dollar for dollar with the underlying stock. To opt-in for investor email alerts please enter your email address in the field below and select at least one alert option. Gamma is the measurement of the rate of change of the Delta.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Thats where youll enter your Form 3921 and thats where TurboTax gets its information for the AMT. Depending on your tax bracket for ordinary income tax purposes long-term capital gains which are recognized when an asset is held for at least one year one day are taxed at a rate of 0 15 or 20.

Calculation of tax for the pay period. Or international securities laws. You exercise your option to purchase the shares and then you sell the shares the same day.

You must click the activation link in order to complete your subscription. Zen Ledgers Bitcoin Crypto Tax Calculator. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. Beyond the federal level taxes in Canada also vary by province. Usually taxable Non-qualified Stock Option transactions fall into four possible categories.

The interview you need is the ISO Exercise and Hold interview thats in the Investment Income section. After submitting your request you will receive an activation email to the requested email address. Tax is calculated based on the GeoCode in the order.

Delta measures the rate of change of the theoretical option value to changes in the underlying assets price.

Stockchase Summaries Of Bnn S Experts Comments On Stocks Bonds And Etfs Investing Investment Tips Stock Trading

How To Determine The Tax Deduction Value Of Donated Items Tax Deductions Deduction Irs Taxes

Infographic Rrsp Versus Tfsa Www Ativa Com Finance Infographic Retirement Savings Plan Investing

Inflation Derivatives Definition Option Strategies Stock Market Investing

Derivative Investment One Of The Best Alternative Investments Option Financial Asset Related Contract Betwe Derivatives Market Tax Deductions Online Trading

Weighted Average Cost Of Capital Wacc Business Valuation Calculator In Excel Business Valuation Cost Of Capital Weighted Average

Compound Interest Calculator Spreadsheet Business Plan Template Free Simple Business Plan Template Business Plan Template

Hedge Fund Investment In Nigeria All You Need To Know Chatmogul In 2022 Investing Hedge Fund Strategies Hedge Fund Investing

Which Country Has The Best Stock Market Engineered Portfolio Stock Market Best Stocks Global Stock Market

Savings Investment Tips 10 Points On Public Provident Fund Ppf Investment What Every Indian Investment Tips Public Provident Fund Savings And Investment

Tickers To Follow Video Aug 03 2021 Day Trading Value Stocks Stock Trading

Pin On Retirement Eol Planning Rving

Mortgage Calculator Mortgage Calculator Nerdwallets Home Affordability Calculato Fre Mortgage Calculator Tools Free Mortgage Calculator Mortgage Amortization

New Free Template Health Insurance Comparison Calculator

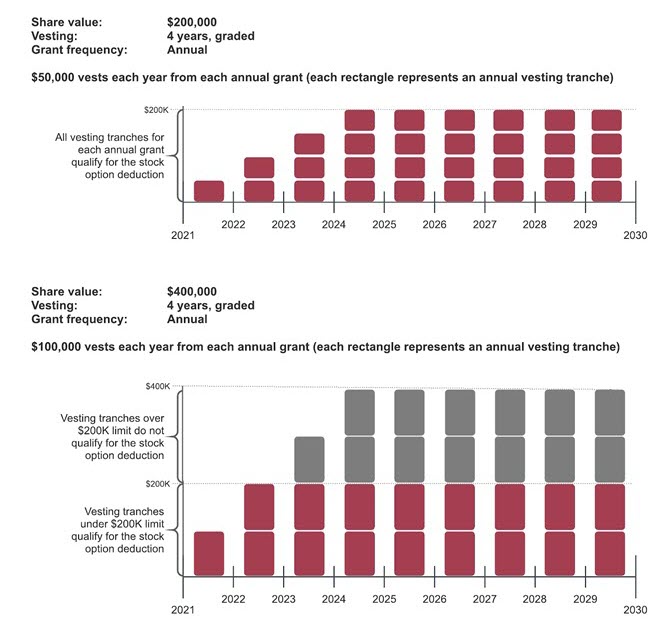

Proposed Changes To Stock Option Taxation

Tax Insights New Rules On The Taxation Of Employee Stock Options Will Be Effective July 1 2021 Pwc Canada

Tax Free Savings Account Tfsa My Road To Wealth And Freedom Tax Free Savings Savings Account Small Business Tax Deductions

Good Tax Accountant In Toronto Tax Accountant Tax Help Accounting

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen